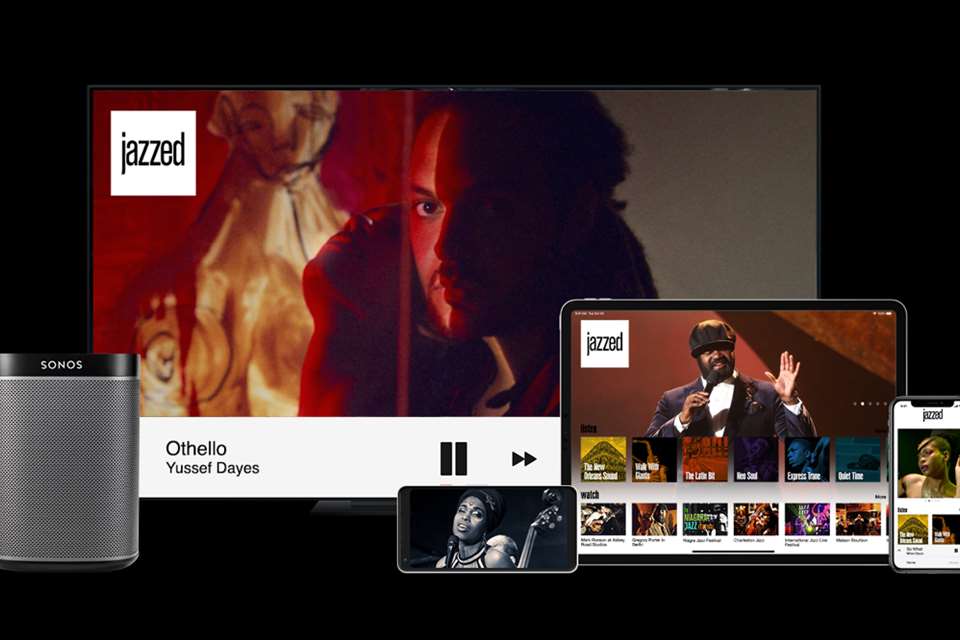

Can jazz survive the music streaming revolution?

Monday, March 2, 2020

With streaming now dominating much of our daily music, TV and movie-watching habits, Stuart Nicholson delves into the digital depths to discover if specialist content, in this virtual sea, will sink without trace

Register now to continue reading

Thank you for visiting Jazzwise.co.uk. Sign up for a free account today to enjoy the following benefits:

- Free access to 3 subscriber-only articles per month

- Unlimited access to our news, live reviews and artist pages

- Free email newsletter